Being a trader, the greatest target is usually to maximize returns on purchases although decreasing failures. Achieving this involves dealers to possess a in depth idea of the financial markets and sound investment methods. One particular strategy that a great many investors neglect is perfecting the art of take profit tactics. In this article, we’ll take a closer look at what take profit is, the various take profit tactics, and how to use them to improve your results.

What is Take Profit?

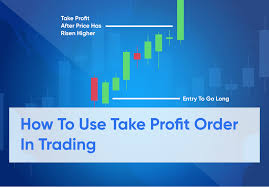

futures trading review is surely an training that is set with a trader that directs their broker to close a buy and sell whenever a predetermined selling price levels has become arrived at. It is actually a trader’s strategy for sealing in earnings. Whenever a trader sets a take profit level, they are essentially establishing the purchase price stage at which they’d like to exit a industry and take their earnings. Take profit can be a danger managing approach that is certainly beneficial in unstable marketplaces where costs can vary rapidly.

Various Take Profit Tactics:

You will find different methods of employing take profit methods, like honest benefit, technological examination, and fundamental examination. One method to use technological assessment would be to establish take profit amounts at vital assistance and resistance ranges. This can be done by analyzing the industry selling price craze and discovering critical levels of help and resistance. As an example, when a trader gets into a trade at $100 and pinpoints a opposition stage at $110, they might set up a take profit degree at $109 in order to avoid the chance of the cost falling beneath the resistance levels.

Yet another strategy is to try using a trailing quit-loss buy being a take profit degree. Trailing end-decrease requests aid to secure revenue by adjusting the cease reduction level as price ranges move in the trader’s love. Because of this if the value moves in the trader’s favor, the stop damage is altered to go by the purchase price to ensure that in case the cost declines, the industry will probably be shut with the end-decrease stage.

Using Basic Evaluation setting Take Earnings:

Fundamental evaluation is another method that dealers can make use of to set take profit levels. This kind of analysis requires the examination of the company’s economic and financial reputation. Traders can make use of essential assessment to figure out a company’s reasonable benefit and set take profit levels depending on that worth. For instance, if a trader believes which a clients are undervalued, they can set up a take profit degree which is higher than the current market price.

To put it briefly:

As a trader, learning take profit methods is essential in refining returns. Dealers should carefully examine the market craze, recognize help and level of resistance ranges, and use technological and basic evaluation to set take profit levels. You must make sure that you have a good understanding of the current market and also the distinct take profit methods accessible before applying them. By perfecting these strategies, you’ll not just be capable of optimize your profits but additionally minimize your loss.